China Goes For The Gold As Huge Investment In African Miner Seen Likely

Analysis

China may have lost out in its dash to get the most gold at the London Olympics this summer, but the country is seemingly still running the race for gold where it counts.

According to the Financial Times, state-owned China National Gold is bidding for a majority stake in African Barrick Gold PLC, a stake now held by Canadian gold miner Barrick Gold Corporation (NYSE:ABX), the world's largest producer of the yellow specie. The move is widely seen as an attempt by the government-sanctioned Chinese mining industry to go head-first into gold mining in Africa.

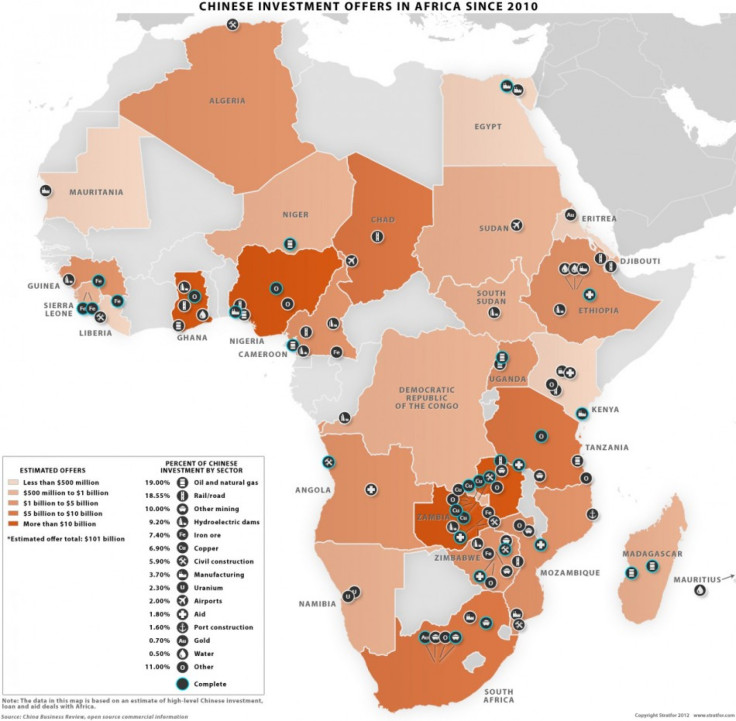

Chinese companies have aggresively bid up African natural resource extraction projects in the past few years, in a government blessed strategy to ensure the mineral-hungry East Asian nation has future access to supplies. According to global intelligence firm Stratfor, Chinese companies have pledged to invest $101 billion in Chinese projects since 2010, of which 90 percent has been in mineral extraction and construction.

Yet only a tiny fraction of that massive money flow, less than $1 billion, has gone into gold. The current deal could easily exceed $2 billion. That would immediately vault Tanzania, a country on the Indian Ocean coast where African Barrick Gold's mines are located that has seen large Chinese investments in oil and natural gas -- but not gold -- among the top four countries to see yuan's rolling in.

Both China National Gold and Barrick Gold, which is being advised by UBS Ltd., put out statements noting discussions were ongiong.

"Discussions are at an early stage, and there can be no certainty that these discussions will result in the acquisition," Barrick Gold said in a statement Friday.

Market-watchers noted, however, that the fact information about the deal was leaking out in the first place is a good indication of the seriousness of Beijing's interest. Also noted was the fact African Barrick Gold has been underperforming market expectations over the past few years, suffering from power outages and crippling theft at some mines to forced shutdowns staged by machete-armed local villagers. Such a situation suggests Barrick may be open to selling to a buyer with a longer time horizon to tighten up operations.

Investors, at least, certainly thought the deal would go through. Shares of African Barrick Gold, which are traded on the London Stock Exchange, were up 8.87 percent to £428.50 ($673.99) in late London trading. Shares of Barrick Gold Corporation (NYSE:ABX) rose $1.30, or 3.75 percent, to $35.99.

© Copyright IBTimes 2025. All rights reserved.