Do You Really Own Your NFT?

News headlines continue to churn out titles that someone bought an NFT for X million dollars. The most recent one to grace the news cycle was from the Bored Ape Yacht Club, selling for $2.85 million, worth 1080.69 ETH. The prized ape, numbered #232, looks like this.

If you right-click on it and select “save image as,” you would download the exact image file that prompted the owner to dish out $2.85 million. To contrast that sum of money, you can buy this luxury home in Dallas, Texas, right now for $1.975 million. The mansion has 5,986 sqft consisting of five bedrooms and six bathrooms.

For $2.85 million, not only could you buy that mansion, but you could also buy a couple of Tesla luxury cars. And then, you would still have enough money to not have to work for the rest of your life. This stark contrast in assets is important to keep in mind.

Clearly, the owner of that Bored Ape didn't buy an image. Technically, they bought a blockchain address for that image that proves the ownership. In turn, this certificate of ownership gives them access to the Yacht Club membership.

Is it like buying access to a secret society, filled with other rich people, who then network with each other?

It could be, as they already have a private BAYC Discord server. More importantly, because it is called a Yacht Club, it invites such a community to form for future gatherings and exclusive drops. However, this is only a part of why NFTs could be valuable.

NFT value examined

When people think of non-fungible tokens — NFTs — they often forget that the “non-fungible” part is not the important bit. Instead, one has to focus on the token, a representation of one's stake in some project. The visual, non-fungible part, whether it is an e-book, animation, or image, is just the entryway to that representation.

In the case of portrait-style NFTs like BAYC or CryptoPunks, the extra benefit lies in tying them to social media profiles, the global town forums. This is why Twitter already integrated this feature with its Blue subscription program. Likewise, both Facebook and Instagram are on their way to doing the same.

In a year's time, it is easy to see all of the social media platforms providing NFT → user avatar pipeline by default. But this is just the first step. These profiles can then be brought into metaverses as verifiable blockchain assets. After all, each NFT is a smart contract that can interact with other smart contracts.

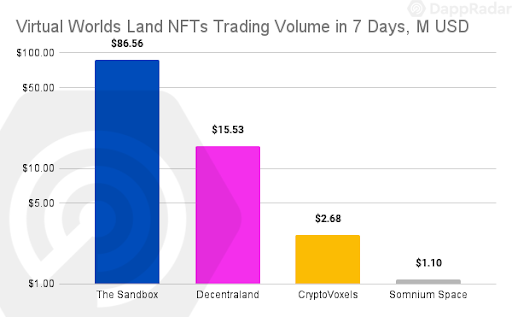

Now, we are starting to see the bigger picture. If an entire Web3 infrastructure is built around smart contracts, NFTs become digital IDs, but anonymous ones. Moreover, they give the owners social clout and access. These are foundational blocks slowly being built, as indicated by the growing sales of NFTs representing virtual land plots.

Even more interestingly, NFTs can represent real-world land parcels. This is the mission of CityDAO, tokenizing land as NFTs in Wyoming. Decentralized Autonomous Organizations (DAOs) rely on tokens to grant users voting rights for proposals and governance. Without a central authority, but with full smart contract transparency.

Therefore, people actually govern NFTs, which means they govern real land ownership. This is a far cry from static Apes that give people access to exclusive social clubs. Furthermore, somewhere in between is blockchain gaming, where any asset can become a collectible and tradable NFT, from playable characters/creatures to skins, weapons, vehicles, etc.

From this emerges an entire new market breed — play-to-earn (P2E) gaming. Previously, gamers could earn a buck only from exceedingly rare and exclusive esport events. The fact that a blockchain game like Axie Infinity is already serving as a source of income in developing countries is a testament for this emerging market.

Are NFTs worth it then?

Simply put, buying an NFT is buying your place on the blockchain network. In turn, this blockchain infers to that asset its smart contract properties — immutability, verification, decentralization, tradability, and extensible programmability. This means that even one NFT class could be transformed into something else later on.

Case in point, Meebits, from the creators of CryptoPunks, sold like hotcakes ($29.2 million last month) because the Larva Labs team didn't just mint static images. Instead, they minted voxel 3D objects files, so they can be placed into metaverse games and 3D modeling and animation software.

If the future of social life is digital, as it appears to be, and heading in the metaverse direction, which both Microsoft and Meta count on, then it is becoming clearer why one would stake their hold in the blockchain space. Whether that is worth to someone millions of bucks is a matter of speculation and perspective.

However, it is important to keep in mind that NFTs don't give the holder total ownership of the artwork. Nonetheless, the same can be said of physical collectibles as well. If one were to buy a painting, the right to publicly display it is not automatically granted.

When applied to NFTs, that means that one could mint an already existing NFT and not break copyright law, unless the license term is already embedded in the NFT. We have already seen such stipulation in action:

- Kings of Leon, the first NFT as a music album, was marked for personal consumption.

- CryptoKitties NFT holders were limited to $100k in resales annually by the Dapper Labs creators.

From this, we can conclude that NFT users should be aware that they are buying speculative assets, just as they would buy speculative physical artworks in galleries. Although NFTs are more flexible because of their digital nature, further boosted by smart contract programmability, it also means they can be reproduced ad-infinitum by scammers.

Perhaps, this is the most important lesson to retain. Verify that the NFT you are buying originates from the original creator. This can be accomplished by tracking down the smart contract address on Etherscan back to the studio's release distribution. Remember, the NFT's core value lies in the blockchain, and every transaction on it is added permanently and transparently as long as the network is online.

With large networks, such as Ethereum, this could be as long as the internet itself is online.

Rahul owns no cryptocurrencies.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2025. All rights reserved.