Former law firm partner charged with helping Starr operate Ponzi scheme

The Securities and Exchange Commission (SEC) has charged Jonathan Bristol, a former law firm partner, with aiding and abetting Kenneth Ira Starr's Ponzi scheme by allowing Starr to use his attorney trust accounts as conduits for transferring the funds stolen from Starr's clients to Starr and his two companies for personal use.

In the civil lawsuit filed in federal court in New York last week, the SEC has alleged that more than $25 million belonging to Starr's clients flowed through Bristol's attorney trust accounts. Without his clients' authorization, Starr would transfer their funds into the attorney trust accounts, and then Bristol would transfer the stolen funds to Starr and his two companies for personal use.

According to the SEC, Bristol never disclosed the existence of the attorney trust accounts to the prominent international law firm Winston & Strawn LLP where he worked at the time. Monthly account statements clearly listing the names of Starr's clients as the source of the incoming transfers were sent directly to Bristol's home address instead of the law firm, the SEC said in a statement. This took place between November 2008 and May 2010.

Meanwhile, Bristol also touted his relationship with Starr to his colleagues and others, claiming that Starr managed $70 billion in assets. In fact, Starr managed only a fraction of that amount, the SEC said.

The SEC said that once when Bristol was confronted by one of Starr's victims about an unauthorized $1 million transfer from the victim's account, he had lied to the victim that the funds were being bundled with other clients' funds for an investment with UBS Financial Services.

In fact, Bristol had already used the misappropriated funds to pay a multi-million dollar legal settlement with one of Starr's former clients, the SEC said, adding that Bristol even subsequently sought to represent that same victim after the victim was contacted by SEC staff in its investigation.

In addition to the fact that such representations violated the ethical obligations of lawyers, Bristol's clear intent was to obstruct and undermine the SEC's investigation in order to conceal the wrongdoing, the SEC said.

Bristol had a legal and professional responsibility not to assist Ken Starr in conduct that he knew was unlawful, said George S. Canellos, Director of the SEC's New York Regional Office. Bristol crossed the line from lawyer to conspirator when he failed to safeguard funds entrusted to him, helped Starr steal client money, and lied to the victims to perpetuate the scheme.

The lawsuit runs parallel to a criminal indictment filed by the U.S. Department of Justice last Thursday which charges Bristol with laundering over $20 million in connection with Starr's admitted Ponzi scheme.

The SEC and the Southern District U.S. Attorney's Office are seeking the forfeiture of Bristol's property, including $20 million.

Winston & Strawn has not been named in either the indictment or the complaint. The firm acknowledges having employed Bristol but added that he is no longer with us in a statement.

Bristol has pleaded not guilty to criminal charges in a federal court in Manhattan. He faces up to 20 years in prison if convicted.

The criminal case is United States of America v. Jonathan Bristol, case number 10-cr-1239, in the U.S. District Court for the Southern District of New York.

The SEC case is Securities and Exchange Commission v. Kenneth Ira Starr et al., case number 10-cv-4270, in the U.S. District Court for the Southern District of New York.

About Kenneth I. Starr

Kenneth I. Starr, financial adviser to Hollywood celebrities and powerful politicians, pleaded guilty in September to charges that he ran a Ponzi scheme and diverted up to $50 million of his clients' money to fund his own lavish lifestyle. He pleaded guilty to one count each of wire fraud, money laundering and investment adviser fraud in the US District Court in Manhattan.

Starr, a financial adviser to Hollywood actors like Uma Thurman, Wesley Snipes, Sylvester Stallone and Al Pacino and directors like Martin Scorsese and Ron Howard, was arrested and charged in May with fleecing his clients by operating a complex Ponzi scam. He was indicted in June by a grand jury in New York on 23 counts including wire fraud, securities fraud, money laundering and fraud by an investment adviser.

In the criminal complaint, the US Internal Revenue Service (IRS) said Starr (not the same Kenneth Starr who served as the special prosecutor in the investigation of former president Bill Clinton's affair with White House intern Monica Lewinsky) ran an elaborate Ponzi scheme that involved his son, wife, prominent New York Democratic Party politician Andrew Stein, a former national official of a major political party, and a partner at a prominent national law firm.

The criminal complaint said Starr, 66, through his investment advisory firms Starr Investment Advisers and Starr & Co, gave financial advice to wealthy New Yorkers including an actress, an elderly heiress, a retired prominent basketball player and a jeweler, without naming them. At one point, Starr managed assets in excess of $700 million and boasted of clients like Sylvester Stallone, Uma Thurman, Wesley Snipes, Al Pacino and Martin Scorsese.

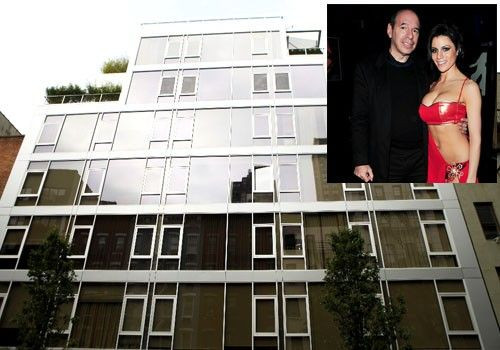

After gaining confidence of his clients and control over their funds, Starr ran an elaborate Ponzi scheme to fund his lavish lifestyle that included purchase of a sprawling Upper East Side condominium for $7.5million and expensive baubles for his wife Diane Passage, an ex-stripper.

The Ponzi scheme ran from January 2008 through April 2010 with the aid of shell companies, the complaint said.

A Ponzi scheme is one in which corrupt money managers use funds from some clients to pay other clients. The scheme collapses when they are eventually unable to meet redemptions.

Starr faces more than 12 years in prison when he is sentenced on February 2.

© Copyright IBTimes 2025. All rights reserved.