The Global Recording Industry Just Saw Its First Meaningful Growth In 20 Years

It took more than 20 years for the recording industry to see meaningful growth return to its balance sheets. But thanks to the explosion in streaming music, an industry that has suffered massive losses since the beginning of the 21st century showed it’s finally turned a corner, and it’s gearing up for some legislative fights it says are necessary to speed that growth up.

The International Federation of Phonographic Industries, or IFPI, released its annual Global Music Report Tuesday, and it showed that the record business grew 3.2 percent in 2015. The growth was spread across the globe, with the biggest gains coming in Latin America, where the industry posted 11.8 percent growth, and in Asia, which posted a 5.7 percent gain. Europe and North America grew 2.3 and 1.4 percent, respectively.

“The music industry has successfully emerged from digital disruption,” Edgar Berger, the chairman and CEO, international of Sony Music Entertainment, said at a press conference announcing the IFPI report’s release.

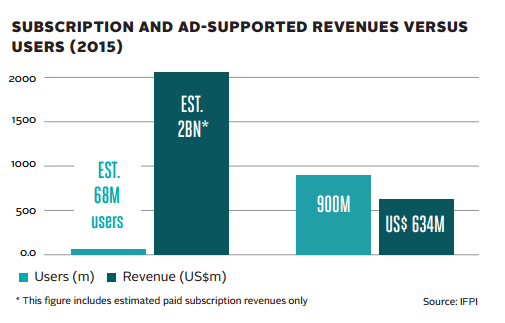

That 3.2 percent is the largest gain the industry had seen since 1995, near the height of the CD boom, and it was indisputably fueled by streaming. In Latin America, streaming revenues leapt more than 80 percent. In the United States, streaming became the record business’ largest source of revenue for the first time, narrowly edging past downloads. Even in Asia, a territory whose largest market, Japan, has yet to embrace streaming, revenues in that category rose nearly 30 percent. The IFPI estimates that 68 million people around the world now pay a monthly subscription fee to access music, a total that’s more than double what it was two years ago.

Yet the report contends that last year’s gains should have been far greater. While subscriptions to services like Spotify drove a big uptick in revenue, the consumption of music on those services was dwarfed by the amount of music consumed on free, ad-supported services like YouTube, which attracts more than 800 million music video watchers every month, according to MIDiA Research. An additional 100 million listen to music that’s been uploaded in different forms. That massive audience generated just $630 million in revenue for the industry, less than four percent of the $15 billion total.

Put another way, Spotify can report it paid the record industry more than $18 per user in 2015, while YouTube paid less than a dollar.

“This is, emphatically, not a fair correlation between the consumption of music and the value that it is generating for artists, creators and investors,” IFPI CEO Frances Moore wrote in the report’s summary.

That disparity, described as a "value gap" by Moore and others, has become a primary area of focus for the recording industry. Indeed, the gap is mentioned more often than albums, songs or CDs in the IFPI's report, and at today's event announcing its release, Moore called closing the gap the record industry's top priority for 2016, and they will fight to close it on several fronts.

They will have several opportunities to advocate for a legislative solution. The European Commission, which published a report late last year recognizing a market imbalance caused by safe harbor laws, will be reviewing its copyright laws this summer. The United States Copyright Office, which recently put out a call for comments on the Digital Millennium Copyright Act, will make recommendations to Congress later this year on potential changes as well.

The major labels will be able to fight to change things at the bargaining table as well. The labels are all busy renegotiating their contracts with YouTube.

© Copyright IBTimes 2025. All rights reserved.