China's inflation pulled back in August from a three-year high, underlining expectations that price pressures have peaked and the central bank can hold off on further tightening of monetary policy in the face of a global economic slowdown.

The yuan's recent gains are helping to tame China's inflation but it is too early to conclude that Beijing has won its battle to cool price pressures, World Bank President Robert Zoellick said on Monday.

Slumping export demand slowed factory activity in some of Asia's biggest economies in August, although China fared better thanks to solid domestic growth, a series of surveys released on Thursday showed.

China's central bankers have found a new way of keeping banks from lending too much, a step Beijing hopes will help it tackle the country's persistent inflation woes.

China's Lion Fund Management Co will launch next week the country's first mutual fund that invests in overseas oil and gas-related assets, as Chinese money managers step up innovation to woo investors haunted by inflation concerns.

The booming eastern Chinese province of Zhejiang has ordered a rise in taxi fares in cities and counties with underpriced cabs following a wave of strikes by drivers demanding higher wages, state news agency Xinhua said on Friday.

Can an earthquake influence the ups and downs of the stock market?

Stocks closed moderately higher today. Compared to the past week, we won’t complain about any advance in the market – however small.

The stock market inched back up this morning as bargain hunters scoured the Big Board for victims of last week’s crash.

With the U.S. recovery having slowed considerably, and Europe debt woes persisting, investors will look to Fed Chairman Ben Bernanke's Jackson Hole, Wyo. speech later this week to provide clues regarding the central bank's evaluation of the economy, and at what point it thinks additional stimulus would be needed.

Inflation in Morocco jumped to 1.8 percent in July from a year earlier, exceeding the average forecast for 2011 for the first time this year, due mainly to a surge in food prices, the state High Planning Commission (HCP) said on Friday.

Gold soared to a new record Thursday as the stock market plummeted on concerns that European banking woes could spread to the United States.

Traders on the U.S. futures market bid up the price of gold to a record high early Thursday on continued concern about the slowing economies of both Europe and the United States.

Shares of exchange-traded funds back by gold and silver rose in premarket trading Thursday as the U.S. government reported a higher-than-expected increase in inflation and an increase in jobless claims.

Striking cab drivers in Hangzhou denouncing rising fuel prices and demanding the government make good on pledges to raise fares abandoned their vehicles for a second day on Tuesday, and planned street protests despite a heavy police presence.

Baby Boomers - the size of your Social Security payment may be lowered, if the current mood in Congress prevails. That's because 'Gang of Six' debt deal plan negotiators want to change the inflation/cost of living formula -- a change that would result in smaller annual payment increases for inflation.

The evidence of double-dip recession in the US economy is growing, with the latest indicators reflecting deteriorated economic conditions not seen in the past three decades.

Torrential rain across south eastern China has displaced or otherwise affected over 5 million people, killing scores and threatening global commodity prices.

Humala takes office and the stocks plummet in the

A slight lead over Fujimori in the polls meant a slump in the Peruvian economy

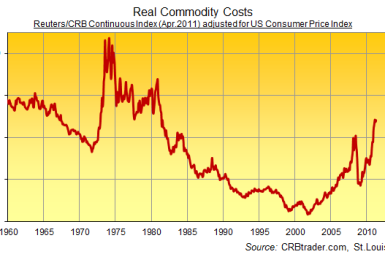

Three trillion dollars is a lot of cash to hoard up in barely 10 years. It's a lot of cash to unleash on the world's commodity markets, too. And peak oil or not, we monetary maniacs might just have a point. Real returns to cash do matter.

The Bureau of Labor Statistics released data Wednesday that indicates New Yorkers earn nearly $1.14 for every $1 the average American worker makes.