The top pre-market NASDAQ stock market gainers are: CPI International, iGo, LJ International, Savient Pharmaceuticals, ASML Holding, A-Power Energy Generation Systems, and Melco Crown Entertainment.

CPI International, Inc. (CPII), which makes broadcast and wireless components, said it agreed to be acquired by an affiliate of private-equity firm Veritas Capital for about $525 million in cash.

Japan's economic recovery showed some positive signs as inflation increased in October for the first time in almost 24 months.

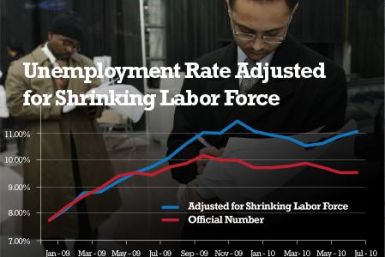

Pessimistic outlook about unemployment from the U.S. Federal Reserve overshadowed reports stating the economy grew faster in the third quarter. The Fed expects unemployment to remain high over the next couple of years, hovering around 8.9 percent to 9.1 percent next year. It had previously forecast unemployment rate between 8.3 percent and 8.7 percent.

An Agricultural commodity price rally in the U.S. will help the wobbly recovery in three ways - by boosting inflation a tad and narrowing the worrying trade deficit by a whisker, while not hardening enough to snuff out the fledgling recovery.

A surge in food prices propelled Chinese consumer prices to a 25-month high in October, despite the government's efforts to control inflation. Food prices in the world’s second largest economy went up by 10.1 percent in October year-on-year.

UK factory orders rose more than expected in November, but the manufacturers expect the output growth to slow in the next three months.

Chinese Premier Wen Jiabao said on Wednesday that the State Council, China’s cabinet, is drafting measures to contain rising commodity prices.

China has stepped up its fight against food inflation by announcing plans for price controls, the selling of government supplies, and subsidies to needy families.

The US dollar dropped against its major counterparts on Wednesday after data showed October consumer price inflation was slower than expected with housing starts data for the same month also coming in at a weaker-than-expected level.

U.S. consumer prices rose lower than expected in October mainly driven by a rise in gasoline prices.

Inflation in the U.K. rose during October, mainly pushed by fuel and lubricant prices, a report by the U.K. Office for National Statistics.

U.S. stocks fell in early trade on Friday as speculation over interest rate hike in China and concerns about euro-zone sovereign debt weighed on the sentiment.

A surge in food prices propelled Chinese consumer prices to a 25-month high in October, despite the government's efforts to control inflation.

Michael Yoshikami, president and chief investment officer of YCMNET Advisors in Walnut Creek, Calif. discusses what exactly QE is, why it may be needed and its potential impact.

The price of gold climbed to a new all-time high of $1,284 per ounce on Monday morning, suggesting that investors are very concerned about inflation that is apparently eroding the value of paper-currencies.