Bitcoin Gold Fork Could Overthrow Cryptocurrency Mining Giants

The season of bitcoin hard forks is upon us. Anyone who engages with the bitcoin community online has probably witnessed several months of Twitter feuds and Reddit arguments ballooning to unprecedented proportions. For example, anonymous trolls sent the SWAT team after Bitcoin Core developer and BitGo engineer Jameson Lopp in North Carolina, using the classic Gamergate tactic of claiming an outspoken critic was holding innocent people hostage with a deadly weapon.

Divergent opinions will lead to several bitcoin hard forks before the year is out, which means a new type of bitcoin. It’s a permanent divergence. The next big fork already gave birth to Bitcoin Gold, which will officially launch over the next few weeks. It kicks off what Forbes reporter Laura Shin called “the battle for bitcoin’s soul.”

"I think the unity of having one bitcoin, 21 million coins, that's absolutely essential for bitcoin's longterm store of value and bitcoin's longterm prospects as being a replacement for the current money system, which is my goal," Bitcoin Gold strategist Robert Kuhne told the International Business Times. "I think by launching a minority fork, that's meant to be an altcoin, that's the difference between this one and Bitcoin Cash or Segwit2x."

Bgold is already being traded on several cryptocurrency exchanges, although the network still isn’t fully up and running. CoinDesk reported 20 wallets and exchanges support bgold so far. However, Coinbase, one of the world’s leading exchange platforms, issued a statement saying they are concerned about the new network’s security and won’t be supporting it until the new currency proves to be relatively sustainable, secure and valuable. Cryptocurrency companies such as ShapeShift and Poloniex issued similar statements.

Bgold’s official website was targeted by DDos attack on Tuesday morning, which is pretty common for divisive or highly publicized blockchain projects. Hong Kong-based entrepreneur Jack Liao, the LightningAsic CEO known for his controversial opinions on bitcoin mining, is spearheading bgold.

One of the biggest security concerns is over something called “replay protection.” Anyone who already owns bitcoin can usually get the new forked version for free, even doubling their number of coins, albeit with different values depending on demand. However, without replay protection, that doubling could cost users big time.

“You might be sending coins on both networks when you only intended to send coins on one of them,” Eric Lombrozo, Bitcoin Core contributor and CEO of Ciphrex Corp, told IBT. “You’d be sending coins on two chains.”

Imagine you have several friends named “Bitcoin” in your contact list and accidently send them both a unique copy of a text meant for just one of them. That's replay. Similar address formats for multiple bitcoin network forks make replay concerns even worse. Forks could also make bitcoin harder to use because these decentralized networks are fueled by community participation. The fewer people who mine bitcoin and act as nodes, the longer transactions will take. Kuhne told IBT he sees the two other bitcoin forks as efforts to detract from bitcoin's original community and supplant bitcoin.

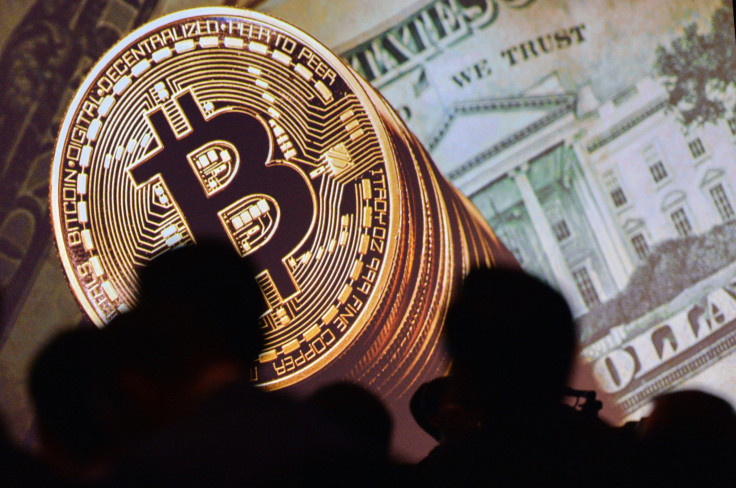

Some people might dismiss all these issues as first world problems that only impact a small community of tech junkies. This couldn’t be further from the truth. Thousands of new cryptocurrency users in countries like Zimbabwe and Venezuela are flocking to bitcoin as their local economies falter.

Quartz reported bitcoin hit a peak price of $9,600 on the Zimbabwe exchange Golix earlier this week, compared to an average of $5,600 at other global markets. “Interest in bitcoin has peaked as people cannot send money outside or pay for international transactions using formal banks,” Golix employee Yeukai Kusangaya told Quartz. “There is currently more demand than supply of bitcoins.”

Many people have wildly different opinions on how to quickly and securely usher more transactions through the pipeline. Almost everyone agrees they want to increase capacity and reduce transaction fees. Bgold’s supporters believe focusing on mining is the key.

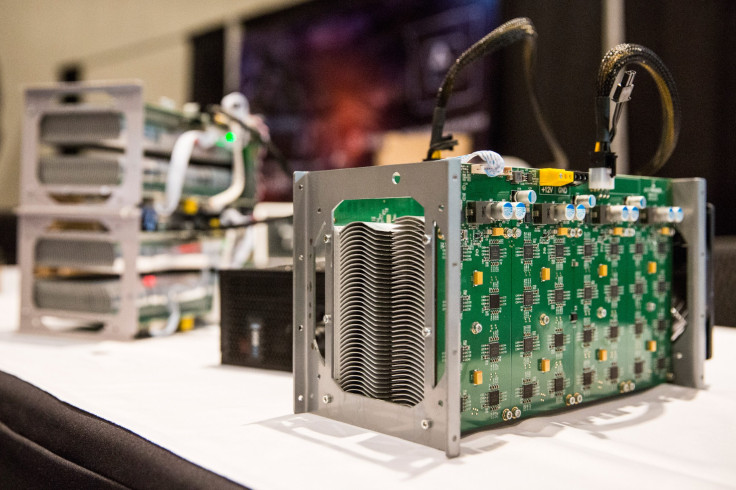

"We're changing the hash algorithm to be competing with altcoins that use GPUs for the hashing power," Kuhne said. Bitcoin miners are kind of like the border control officers who check your passport at the airport. Mining, aka running a special software that sucks up a lot of computing power, validates transactions and enters them into the shared records across the bitcoin network. This sometimes means average users hook up DIY hardware in their house to run the mining software. However, Chinese companies now control the bulk of the world’s most powerful, industrial-sized bitcoin mining machines.

Since the bitcoin community generally values peer-led networks over enterprise services, this upsets many users. They don’t want the network to be dominated by corporate gatekeepers. Old bitcoin mining algorithms won’t be able to mine bgold, which the fork’s supporters argue will help level the playing field again. A report by the Cambridge Centre for Alternative Finance estimated bitcoin miners have collectively earned $2 billion since 2008.

"What we're trying to do, changing to a different hash algorithm, is a friendly fork," Kuhne said. "Bitcoin needs to be able to flexible enough to change that, the hash algorithm. And hard forks are considered by everyone, or at least most experts, to be very risky."

Many bitcoin veterans aren't convinced the bgold model will actually solve this core mining problem.

“I think that it’s a noble goal, but unfortunately I don’t think it will really live up to it,” Lombrozo told IBT. “Any coin that becomes sufficiently profitable to mine...at some point people are going to try to optimize on hardware….I think the best that we can hope for at this point, with current technology, is a bit of a reset. A bit of reshuffling.”

Bgold hasn’t garnered the same support from businessmen as the upcoming November fork, Segwit2x. “Bitcoin Gold does have some grassroots support and I think there are people who do have this idealistic notion that mining should be more decentralized...a common cause that could rally people together in an organic sort of movement,” Lombrozo said. “Whether or not they can actually execute on that is another matter...Segwit2x, on the other hand, was a top down corporate thing. The idea was to force everyone to join the new network.”

Despite public outcry, Coinbase officially declared it will call the chain "with the most accumulated difficulty Bitcoin." This means after the November fork, Segwit2x could graduate from an altcoin to become the new dominant bitcoin network, at least in the eyes of Coinbase. One of Segwit2x’s most prominent developers, Bloq CEO Jeff Garzik, announced on Tuesday his startup will soon launch its own cryptocurrency that will work across different blockchain networks. Some critics see this as a quiet step back from the controversial Segwit2x project, to help avoid infighting over network forks. Kuhne refered to Segwit2x as a hostile corporate movement, in direct contrast to bgold's "friendly fork" approach. Nolan Bauerle, director of research at CoinDesk, told IBT Segwit2x was "all about high profile support," which bgold lacks.

“If you look at their [Segwit2x ] data depository, it’s almost dead. There’s almost no activity on there,” Lombrozo said. “I just don’t see them [forks] as viable competitors...So now it seems that it’s really hard for another bitcoin fork to kind of steal the [original bitcoin] brand unless it really offers better usability and better resistance to takeovers and better fungibility. If it really does, then it should win.”

Bgold has the potential to shake up the cryptocurrency mining industry, if it can attract more supporters. It so far has less high profile support than the summer bcash fork that sparked the new age of bitcoin forks. At first, most of the code changes came from just one developer, Liao himself. But the community is growing quickly.

"There's no doubt that mining has become centralized to an extent, or at least that the barrier to entry is now significant," Bauerle told IBT. "The gold fork is looking to change the mining industry...we'll have much more insight after the more important fork [Segwit2x] in November."

Update: This story was updated to include an announcement from Coinbase, clarifying their previous stance on Segwit2x.

© Copyright IBTimes 2025. All rights reserved.