Dell Shares Plunge After Poor Earnings, Forecast

Shares of Dell, the No. 3 PC maker, look likely to fall sharply Wednesday after the company reported earnings below estimates and issued a dismal forecast.

Before the opening of U.S. markets, Dell was at $17.03, down $1.18 or nearly 6.5 percent below Tuesday's close. That could knock the value of the company as much as $2.1 billion at the outset.

At Tuesday's close, the Round Rock, Tex.-based PC giant was valued at $32.7 billion.

The move on Dell could foreshadow the first-quarter financial report of Hewlett-Packard, the No. 1 PC maker, scheduled for after Wednesday's close. In pre-market trading, HP shares fell only 15 cents, to $29.35, valuing the world's biggest computer services company at $58.4 billion.

Dell reported fourth-quarter earnings two cents below estimates as revenue rose slightly above expectations.

Operating earnings were 51 cents a share, on revenue of $16 billion, about $500 million above estimates.

Dell shares had surged nearly 25 percent this year. They fell 3 percent as soon as earnings were announced, apparently because the results did not exceed estimates, like those for Apple.

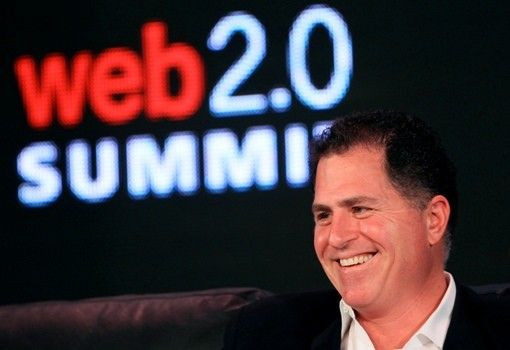

We are more committed than ever to both developing and investing in innovative solutions, said founding CEO Michael Dell. At the same time, Dell estimated first quarter revenue will slide another 7 percent, to about $14.9 billion, compared with analysts' estimates of at least $15.1 billion.

Growth in PC sales is hardly skyrocketing. For 2011, market researcher Gartner estimates, Dell's increase was a meager 1.8 percent although that was nearly triple the anemic 0.5 percent growth in the overall market.

Dell's share was 12.1 percent of the overall 352.8 million PCs shipped, Gartner said. Only Hewlett-Packard and China's Lenovo Group sold more.

Revenue was expected to rise only 1 percent to $15.94 billion from the year-ago figure or only $57 million from last quarter's $15.37 million. In fact, it was $16.03 billion.

Dell, which closed its fiscal year Feb. 2 like most major retailers, reported full-year net income of $2.13 a share on revenue of $62.07 billion, far better than 2011's net of only $1.35 on revenue of $61.49 billion.

Last quarter, Dell, generated nearly 20 percent of revenue from services, mainly software, which generates higher margins than selling PCs and servers. That was 6 percent ahead of 2010 and helped Dell increase its gross margins to 22.6 percent from only 19.5 percent a year earlier.

Dell has acquired various services providers in recent years including Perot Systems, SecureWorks and Compellent, which enable the company to better compete against rivals Hewlett-Packard, No. 1 in computer services and PCs, and IBM.

Dell recently hired John Swainson, the former IBM executive brought in to clean house at troubled software developer CA Technologies, the latest name for the former Computer Associates, as president of software.

The company may well be on the prowl to buy a midsized software company. Dell will also report its cash and investments. They rose to 18.16 billion from $16 billion last quarter.

At that level, surmises analyst Peter Misek of Jefferies, Dell might look at a company slightly less valuable than Houston-based BMC, valued at nearly $6.5 billion, such as Quest Software, valued at $1/73 billion or CommVault Systems, valued at $2.4 billion.

Oceanport, N.J.-based CommVault is more in the storage sector, which would help Dell compete better against EMC, which already resells products through Dell, as well as Oracle.

Misek left Dell on his Hold list with a price target of $17.

Potentially, CEO Michael Dell, 46, who founded the company in his dormitory at the University of Texas, could also face a challenge: last week, Greenlight Capital, the hedge fund managed by David Einhorn, said it had acquired 14 million shares.

That probably wouldn't be a problem considering that Dell himself still owns 243 million shares, or 14 percent of the outstanding equity.

© Copyright IBTimes 2025. All rights reserved.