Election 2016: Jeb Bush And John Kasich’s Work At Lehman Spotlights Different Revolving Door Between Business and Government

Republican presidential rivals Jeb Bush and John Kasich bring to their campaigns their experience as governors of major battleground states, but they also share a resume line from their time in the private sector. The Florida and Ohio pols both worked at the ill-fated Wall Street investment bank Lehman Brothers just as the firm was racking up vast losses for their states' respective pension systems.

While Kasich has denounced Wall Street greed and Bush has criticized lawmakers who become lobbyists, during their time at Lehman they leveraged their public sector experience -- Bush as a former governor and Kasich as a former nine-term congressman -- to help the bank build relationships and navigate public policy matters.

Those roles spotlight a lesser-known revolving door between corporations and government.

Rather than becoming traditional lobbyists, “these kind of people serve as door openers,” said Jeff Hooke, an investment banker who worked at Lehman Brothers in the 1990s. “Sometimes it’s hard for a normal investment banker -- even a senior guy -- to get a CEO or a finance minister to return his calls to present them with a new idea, so a guy like Jeb Bush, whose name is instantly recognizable or has lots of contact from his fundraising days or governorship or his family -- he’s going to get his calls returned.”

Bush and Kasich received big Lehman paychecks as the bank’s mortgage-backed securities decimated the investments intended to support their states’ retired workers, and today, both are getting financial support for their presidential campaigns from donors they worked with during their time at Lehman.

Neither Bush nor Kasich was registered to lobby for Lehman on regulatory matters. A spokesman for the Kasich campaign, Scott Milburn, told International Business Times that Kasich “was in the investment banking division” and “worked as part of coverage teams across a variety of sectors” doing mergers and acquisitions, initial public offerings and other financial deals.

In response to IBTimes' questions, Bush's campaign issued a statement saying "Governor Bush was an independent senior adviser who offered clients his perspective on the impact of economic trends, regulations and policies could have on sectors/business." In 2012, Bush told lawmakers he was an “adviser” to the firm who “spent most of my time dealing with their customer base.”

Ethics experts say leveraging public sector relationships for private interests is a cause for concern.

"There's been an effort to stop the revolving door with lobbying, but little effort to stop this backroom revolving door,” said James A. Thurber, a leading ethics expert and professor at American University. “It's a problem because you want public investments to be considered in the general public interest. But hiring politicians evokes narrow personal interest, because politicians bring with them a network of relationships, clout and political intelligence that the public doesn't have."

The list of public officials following this path is growing.

On the Democratic side, former President Bill Clinton advised the Yucaipa Companies, which manage money from public and union pension funds. Ex-Obama Treasury Secretary Tim Geithner now works at Warburg Pincus, where he recently promoted the firm to New Jersey pension trustees. Former New York State Comptroller Carl McCall, a Democrat, worked as a placement agent raising money for private equity firms from pension funds he used to oversee. Former Clinton Treasury Secretary Larry Summers took a lead role in a strategy for DE Shaw, a major hedge fund, that a former colleague of his calls “a way of collecting dumb money from pension funds.” And former House Democratic Whip David Bonior of Michigan now works for EnTrust Capital, which manages state and union pension fund money.

Some Republicans have followed the same path: Former President George H.W. Bush and his appointees James Baker and Robert Grady left the public sector and eventually ended up at the Carlyle Group, a Washington-based private equity firm whose deals have often involved government contractors. More recently, retired Gen. David Petraeus, a registered Republican, has appeared with pension officials in North Dakota and South Carolina on behalf of KKR, a major private equity firm. After retiring from the U.S. Senate, Mel Martinez -- a former secretary of housing and urban development -- also got a job at J.P. Morgan overseeing the firm’s business in his home state of Florida.

But in the 2016 presidential race, Kasich and Jeb Bush’s tenures at Lehman represent the most prominent version of the trend.

‘They Want These Kind Of People For Their Rolodex’

Kasich was hired to help run Lehman’s investment banking operation in January 2001 despite, by his own admission, having “close to zero” knowledge of the business. He was, however, a longtime ally of the financial industry during his 18 years in Congress. He voted for legislation to eliminate regulations on banks like Lehman. The month before he got the job at Lehman, Kasich sponsored a bill to allow Social Security money to be invested in financial firms -- including inevitably Lehman -- that stood to make hundreds of billions in profits had it passed.

Over his congressional career, Kasich was rewarded for that allegiance with more than $330,000 worth of campaign contributions from the securities and investment industry, according to data compiled by the Center for Responsive Politics. When he left Capitol Hill for a job as a managing director in Lehman’s Columbus office, those who worked with him said he operated as a relationship-builder and political navigator -- not someone charged with pressuring federal regulators.

"He was known in the Midwest,” said Kasich’s Lehman boss Gary Weinstein in an interview last year with the Cleveland Plain Dealer. “We introduced John to all of our bankers and said, 'Here's a guy who knows more about Washington than any of us here. If anyone wants to work with him, there's no charge to you. If you're a young banker and you want to have some gravitas in the room, you might want John.'"

Another Lehman executive, Glenn Schiffman, told the Columbus Dispatch that Kasich had "board-level and CEO relationships where he helped not only open the door for Lehman Brothers, but he also was a key member of the deal team providing advice."

That description tracks with what experts say retired politicians with no prior Wall Street experience can bring to a banking giant like Lehman.

"They want these kind of people for their Rolodex and their deeper knowledge of the political terrain,” said Eileen Appelbaum, a private equity expert at the left-leaning Center for Economic and Policy Research. “Politicians have deep knowledge of how to shift the terrain, where the levers of power are, and what a company needs to do to deal with the regulatory enforcement or alter the rules.”

Kasich is a case in point: While he never registered as a Lehman lobbyist, within two years of being hired by the bank, he was involved in meetings with Ohio pension officials to pitch them on investing in Lehman. While Kasich served as one of the bank’s point people, Ohio pension funds for police officers, firefighters and highway patrol opted to hire Lehman to manage -- and earn fees from -- retirees’ savings in 2005 and 2006.

In the lead-up to Lehman going bankrupt in 2008, Ohio’s pension systems faced losses of between $220 million and $480 million on various investments in Lehman’s mortgage-backed securities. In the same year those losses mounted, Lehman gave Kasich a $432,000 bonus. Tax records show Kasich was paid a total of $587,175 by Lehman in 2008, the only year for which records are available.

Kasich has acknowledged he set up meetings between Lehman executives and state pension officials. But his representative said in 2010 that "these meetings did not result in business for Lehman Brothers, and John earned no commission from this or any other public sector business." For his part, Kasich said that after he set up the meetings, Lehman executives “came in and made a presentation and nothing ever came of it and I was not involved in it.”

Soon after Lehman’s mortgage-backed securities imploded and the firm declared bankruptcy, Kasich launched a successful 2010 bid for governor in which he raised more than $1.1 million from the financial industry. During the race, one of his campaign policy advisers was a longtime Lehman lobbyist, and Ohio records show that another campaign aide advised state pension officials on how to answer questions about the state’s Lehman losses.

Assuming office a few years after Ohio’s big Lehman losses, Kasich hired another Columbus-based Lehman executive as one of his top advisers. In 2012, he signed legislation forcing firefighters, teachers and other public employees to contribute more of their paychecks to the pension fund -- a move that Kasich said was necessary to begin “stabilizing the systems.”

‘Related to Client Interface’

Jeb Bush’s relationship with Lehman similarly depended on his value as a rainmaker with public sector expertise and a vast network of contacts.

Bush was hired by Lehman Brothers in June 2007 -- just a few months after he left the Florida state house -- to a $1.3 million-a-year job as a consultant. In the two years before Bush was hired, the Florida State Board of Administration -- which he had helped lead as governor -- invested roughly a quarter-billion dollars in a Lehman fund that ended up generating $5 million in fees for the firm. Roughly two months after Bush was hired by Lehman, the SBA -- whose day-to-day operations were still then run by a Bush ally -- bought $842 million of mortgage-backed securities from Lehman.

Four months after those purchases in July and August 2007, the securities Florida purchased from Lehman began to go south, eventually leaving the state facing up to $1 billion in losses.

Bush denied any role in Florida's decision to use pension money to purchase the securities from Lehman. Bush’s “role as a consultant to Lehman Brothers was in no way related to any Florida investments,'' his spokeswoman Kristy Campbell told the Tampa Bay Times in 2009. To suggest that Bush had anything to do with Florida’s investment in Lehman was “incorrect and baseless conjecture,” she asserted.

Florida’s investments in Lehman during Bush’s time as governor and after were made by the SBA when it was run by a close Bush ally; emails show that Bush, as governor, consulted with him about state investments. In a statement to IBTimes, Bush's campaign said, "Governor Bush's role at Lehman had nothing to do with Florida investments."

At a congressional hearing in 2012, Bush told lawmakers he shared “his experiences with customers to try to add value in their relationship.” Bush’s job at Lehman “was related to client interface,” he declared.

Evidence about Bush’s precise role at Lehman remains scarce, but emails and news accounts show that the firm’s executives saw him as a conduit to powerful figures.

In one instance, Lehman’s CEO Richard Fuld reportedly considered the idea of having Bush approach his brother, then-President George W. Bush, about reaching out to Britain's prime minister to discuss letting Lehman merge with a bank in the United Kingdom. In his appearance before Congress, Bush said he was never ultimately asked to take such an action.

In another case, emails show that as the bank was collapsing, Lehman executives had Bush spearhead what they called “Project Verde” -- an unsuccessful effort to convince Mexican billionaire Carlos Slim, one of the world's richest men, to invest with Lehman. A representative for Slim told Fox Business News that he and Bush have been “friends for 20 years.”

Such connections, say investment experts, can be especially useful when they come with a famous last name like Bush.

“People who have celebrity of any kind are inherently valuable in the context of access and getting meetings,” said Michael Flaherman, a former chairman of the investment committee at the California Public Employees Retirement System. “The dominant source of investment capital is from the government in the form of pension funds, state university endowments and sovereign wealth funds around the world. So if celebrity is valuable in general for access, political celebrity has special currency when it comes to government business.”

Bush is now benefiting from the relationships he made at Lehman: According to campaign finance reports, two donors who list Lehman as their employer have donated $30,000 to the super PAC supporting his campaign. On top of that, the group received more than $250,000 from former Lehman managing director Stephen Lessing and $105,000 from George H. Walker IV, a Bush cousin who led Lehman’s asset management business.

‘Just A Hard-Working Banker’

On the campaign trail, both Bush and Kasich have portrayed their private-sector work as experience that distinguishes them from many of their rivals. In Bush’s case, he has not specifically mentioned his tenure at Lehman -- instead, he has used more general rhetoric, saying, “I’ve actually signed the front side of a paycheck, which puts me in a different category” from other candidates.

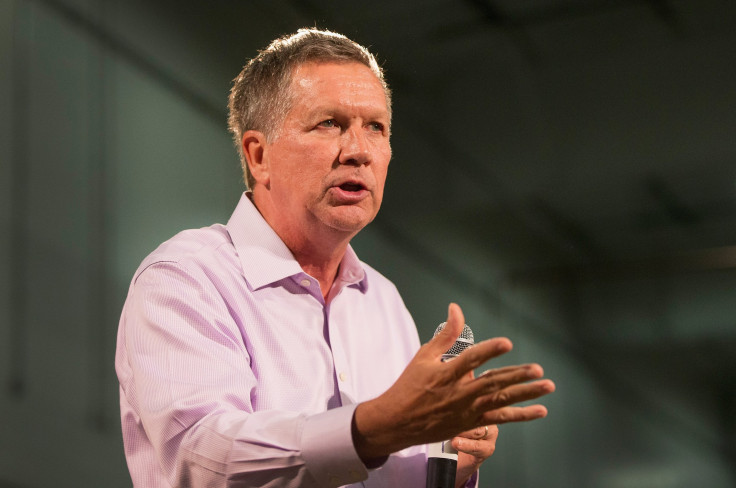

Kasich, by contrast, has discussed his tenure at Lehman -- which was a delicate matter when he ran for governor in 2010, during the depths of the recession. During his first statewide campaign in Ohio, he said that while some might believe that he was “hanging out at board meetings and helping to make executive decisions” at Lehman, he was actually “just a hard-working banker traveling the country.” He declared in a television ad: “I didn’t run Lehman Brothers. I was one of 700 managing directors. I worked in a two-man office in Columbus.”

Lately, though, he has explicitly touted his time at Lehman as an experience that prepared him for the White House.

“I learned a lot about the way America works when I worked at Lehman Brothers,” he said while campaigning in New Hampshire. “I learned how entrepreneurs worked; I learned how boards of directors think. If you want to rebuild this economy, you better have somebody elected that understands the economic situation in this country and what makes businesses invest.''

Some critics, however, say Bush and Kasich’s tenure at Lehman is nothing to brag about.

“When you go to Wall Street after serving in public office, you either go left brain or right brain," Leo Hindery Jr., a longtime private equity and media executive, told IBTimes. "Right brain is more common and relates to domestic financing opportunities, especially municipal bonds and infrastructure financing, while left brain is more of a macro door opener with CEOs and world leaders. Both approaches are basically using connections, which ethically would be best left unconnected.”

This story was updated at 10:17am ET to include comments from Bush's campaign sent to IBTimes after press time.

© Copyright IBTimes 2024. All rights reserved.