Job Growth to Boost Office, Industrial Markets, but Recovery Remains Uneven

Improved job growth and positive leasing fundamentals point to continued recovery in the office and industrial sectors, but buyers continue to focus on major cities over tertiary markets, according to a webcast on Tuesday from commercial real estate brokerage Marcus & Millichap.

From the start of the year through October, hiring increased in most industries compared to the previous year, excluding the financial, information and government sectors, which lost a combined 370,000 jobs year-over-year.

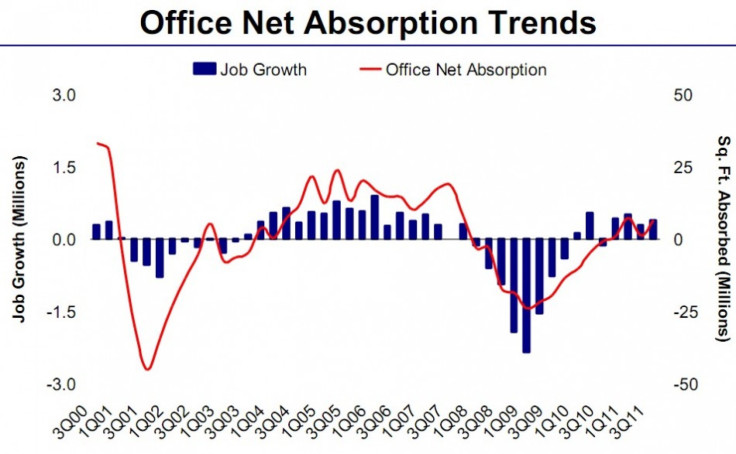

In aggregate, the U.S. economy added 1.5 million jobs. The professional and business services sector posted the largest gain of 562,000, a 3.4 percent increase, another positive sign for office leasing. Job growth is in range of 30-year historical averages following recessions.

Hessam Nadji, a managing director of Marcus & Millichap, said the U.S. economy should add 2.2 million jobs in 2012.

Office and industrial transactions have returned to 2003 levels and should return to 2004 levels, according to Al Pontius, senior vice president and managing director at Marcus & Millichap. Lack of industrial and office overbuilding - in contrast to the residential sector - will also help the recovery.

Office net absorption, which measures the amount of aggregate space leased or made vacant over a quarter, has been positive this year, in line with job growth. Industrial net absorption has also posted gains.

There is plenty of space out there that is underutilized, said Pontius during the webcast. The excess space is something we have to burn through. The good thing is, we are burning through it. I think we're in pretty good shape going forward.

The U.S. average office vacancy rate was 17.4 percent in October, down 20 basis points year-over-year. Major gateway cities have the lowest office vacancy, including New York with 10.6 percent, Washington D.C. with 13.1 percent, San Francisco with 14.3 percent and Los Angeles with 14.7 percent. The bottom cities are Detroit, with 26.7 percent vacancy, Phoenix, with 26.4 percent, Inland Empire in Southern California with 25.4 percent and Las Vegas with 25 percent.

Low interest rates have driven capital markets - the sale of properties and mortgages - but investors continue to focus on large, primary cities, targeting Class A and B buildings. In smaller markets, capital is spotty and financing can be difficult to secure, but the Blackstone Group's recent $1 billion acquisition of an 82-building portfolio from Duke Realty Corp. is another encouraging sign for the suburban market. Lending has been driven by life companies, local and regional banks, commercial mortgage backed securities and debt funds.

The capital markets should continue to be similar in 2012, with financing being asset and location-dependent, said Marcus & Millichap. The top 10 most active office markets - New York, Boston, Chicago, Dallas-Ft. Worth, Houston, Los Angeles, San Francisco, San Jose, Seattle and Washington D.C. - dominate transactions, with 67 percent of year-to-date transaction volume at the end of the third quarter.

While the commercial markets have improved, problems in the residential sector and consumer spending continue to dampen the overall picture.

We are getting closer to bottom, said Marcus & Millichap's Nadji, referring to residential housing. We don't anticipate a meaningful recovery until 2013.

© Copyright IBTimes 2025. All rights reserved.