The Platform Making Fine Wine and Spirits as Easy to Collect as Watches or Sneakers

Fine wine and premium spirits are no longer confined to the cabinets of connoisseurs or the vaults of collectors. A growing number of investors are treating bottles the same way others treat sneakers or luxury watches—assets with both personal value and long-term return potential.

Decant Index, a digital platform developed by Decant Group, is helping lead that shift. It offers a structured way for people to buy, store, and track investment-grade wine and spirits through one interface. With more than 44,000 users and over $6.1 million already returned to clients, the platform is proving that tangible collectables have a place in modern portfolios.

Breaking Down Barriers to Entry

Traditionally, entering the spirits investment world meant having industry connections or deep pockets. Decant Index aims to make it far more approachable.

"Our mission with Decant Index is to democratize access to this compelling asset class," said Alistair Moncrieff, CEO of Decant Group. "By offering data-rich resources alongside curated collections at various price points, we empower both first-time buyers and seasoned investors to participate with confidence."

Entry points are intentionally flexible. American whiskey options start at $2,500, and the Wine Cellar Plan allows monthly investments starting at $330. So far, the platform has handled more than 1,618 successful investment exits and distributed over $6.1 million to its members.

Digital Access, Real-World Security

Even though Decant Index is built as a digital-first experience, it hasn't ignored the physical realities of collectable assets. In 2024, Decant Group—under its own unique brand of Decant Bond—opened a bonded warehouse in Alloa, Scotland, equipped with climate control and security features. The facility ensures secure, insured storage for all assets.

Moncrieff says the warehouse is a key part of the long-term strategy. "We designed Decant Index to offer not just digital convenience but also real-world assurance of quality and authenticity."

The company also hosts tasting events and collector meetups through its membership program, offering users the chance to engage with the assets—and the people behind them—offline.

Collecting on a Global Scale

As global interest in alternative assets grows, Decant Index is expanding its offerings. In addition to whisky and wine, the platform recently added high-end rum to its inventory. U.S. expansion is also a priority, especially as demand for Bourbon continues to rise. According to the Distilled Spirits Council, sales of super-premium Bourbon rose 18% from 2020.

The platform's includes customized portfolio plans and flexible exit options, aligning with a market that values both control and liquidity. Decant Index isn't just building a place to invest—it's building infrastructure for a global collectables economy.

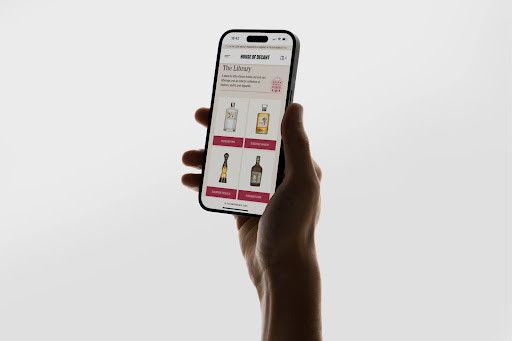

Decant Group's New E-commerce Platform: House of Decant

Soon to launch fully into the market, House of Decant is Decant Group's dedicated e-commerce platform — luxury retail, reimagined.

It offers a curated, concierge-led experience with fast delivery, flexible subscriptions, and a home for both heritage labels and emerging brands.

"We're building a platform that redefines how premium wine and spirits are discovered, purchased, and enjoyed — tailored for the expectations of the modern luxury consumer," says Chris Seddon, Managing Director of Decant Group.

Shop with House of Decant here.

© Copyright IBTimes 2025. All rights reserved.