Starwood Property Trust Net Income Drops to $14.5 Million, Citing CMBS Slowdown

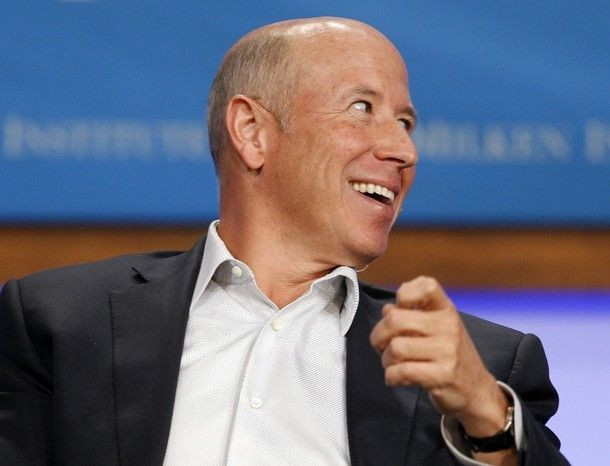

Barry Sternlicht's Starwood Property Trust reported net income in the third quarter of $14.5 million, down from $22.7 million in the same period in 2010.

Starwood, a commercial real estate finance company that originates mortgage loans, had core earnings in the third quarter of $39.3 million, or 42 cents per share, up from $36.1 million, or 43 cents per share, in the previous quarter.

The company, which is an affiliate of Starwood Capital Group, will issue a dividend of 44 cents per share in January.

Officials from the company said volitility in the commercial mortgage backed securities (CMBS) market hurt the company's loans and ability to acquire new property. The CMBS markets came to a temporary standstill during the third quarter after Standard & Poor's downgraded U.S. credit rating and has been slow to recover. Because of the CMBS slowdown, Starwood's loans and hedges declined by $12.7 million, the company said.

During the third quarter, Starwood originated loans, acquired or funded $193.3 million in new investments, including $69.4 million in target investments, bringing the company's total net investments to $2.4 billion.

The company originated a $60.5 million mortgage for two retail centers in Pennsylvania. It also acquired $8.3 million in first mortgage loans for Maryland and Virginia hotels for $7.3 million. However, it had to slow its activity in deference to economic concerns, said Sternlicht, chairman and CEO of Starwood. Some pending deals did not close because of due diligence concerns or pricing.

We had to sidestep the potholes, said Sternlicht. We had to slow down.

But he added that decreased competition from the CMBS slowdown could benefit Starwood in the future, because there was less competition.

The only big lenders are the life companies. said Sternlicht. The European banks are pulling out of the U.S., for the most part.

He said that the firm's $2.1 billion portfolio of mortgages held for investment and CMBS available for sale had an expected return of 11.9 percent.

Stocks of the company were trading under $19 per share on Friday.

© Copyright IBTimes 2025. All rights reserved.