Unilever Reports Sales Growth, but Still Expects 'Flat to Slightly Down' Operating Margin in 2011

Unilever (ULVR), the second-largest global consumer goods company, posted an underlying sales growth of 7.8 percent in the third quarter, but said profitability for the fiscal year still may fall.

The company posted sales of €12.1 billion versus year-ago sales of €11.5 billion, largely driven by strong sales in emerging markets - a 13.1 percent increase in markets like Brazil, India and Indonesia.

Still, Unilever said its underlying operating margin would likely remain flat or fall slightly because of the rising cost of commodities.

I am pleased to report another good quarterly performance, with particularly strong growth in personal care and the emerging markets, reinforcing our position as the emerging markets consumer goods company, Unilever CEO Paul Polman said in a statement along with the company's earnings report.

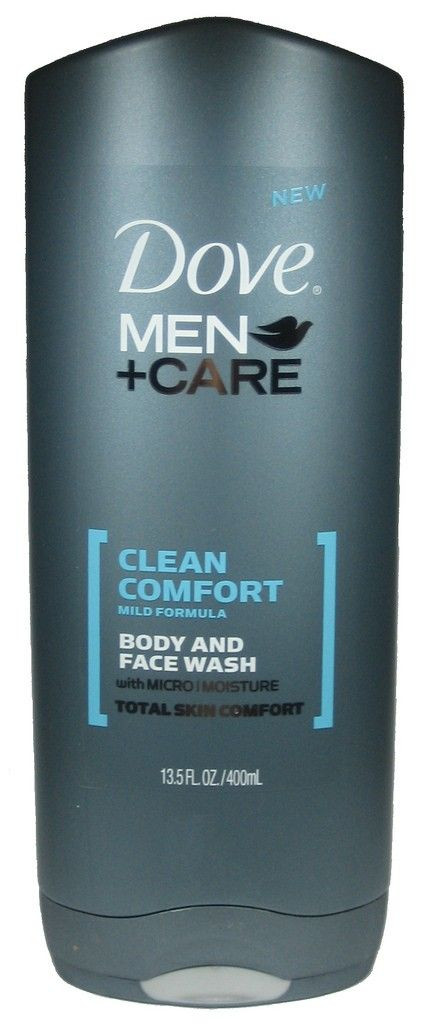

Personal care grew by 11.3 percent, led by Dove products. Across its board of products - including Dove soaps, Lipton teas, Axe skincare products, Blue Band margarine and Hellman's mayonnaise - Unilever increased prices by almost 6 percent.

In its first two quarters of 2011, Unilever saw similar increases in underlying sales growth - 4.3 percent in the first quarter and 7.1 percent in the second quarter. Competitors like Nestle and the U.S.'s Procter & Gamble grew 6.8 percent and 4 percent in the third quarter, respectively, by comparison.

Unilever said in April that commodity costs for the company would jump as much as 15 percent. Differing from many of its competitors, Unilever uses vegetable oil, palm oil and chemicals for spreads, body and laundry products. Palm oil, for example, has leaped in price in the past year - as much as 40 percent, according to Bloomberg.

On a conference call Thursday, CFO Jean-Marc Huet said the company has spent 2.5 billion euros more this year compared to last year on commodities.

While sales also grew throughout Asia and in Africa and the Americas, they fell in Europe.

Last month, Unilever purchased the Russian skincare company OAO Concern Kalina, which makes Axe deodorants and skincare products, for nearly $700 million. This, Unilever hopes, will add to the jump in personal care sales and more long-term success.

Our long term priorities remain, Polman said in the statement. Deliver profitable volume growth ahead of our markets, steady and sustainable underlying operating margin improvement and strong cash flow.

Write to Brett LoGiurato at blogiurato@IBTimes.com.

© Copyright IBTimes 2025. All rights reserved.