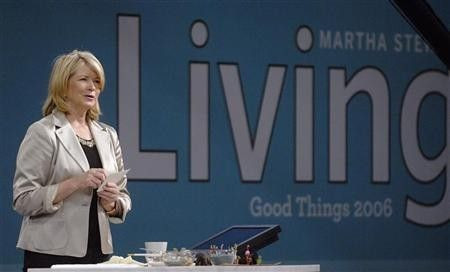

Penney CEO Calls Martha Stewart Deal a 'Centerpiece'

(Reuters) - J.C. Penney Co Inc (JCP.N) bought a 16.6 percent stake in Martha Stewart Living Omnimedia Inc (MSO.N) and will build mini-stores under that brand in a deal new Chief Executive Officer Ron Johnson called a key centerpiece in the company's transformation.

The department store chain, which bought the Liz Claiborne brand in October, said on Wednesday that it had paid $38.5 million for the stake, a 12.2 percent premium above Martha Stewart Living's closing share price on Tuesday. Penney will get two seats Martha Stewart Living's board.

Martha Stewart Living's shares were up 28.2 percent at $4.00 in morning trading, while Penney dipped 0.2 percent to $33.23.

This is the first major deal by Johnson, who took Penney's reins last month and is renowned in the retail world for creating the wildly successful Apple Inc (AAPL.O) stores.

Johnson, who told investors last month that he wanted to transform Penney, not merely improve it, said the deal aimed to unlock the full potential of Martha Stewart's assets.

The arrangement calls for Martha Stewart store-in-stores to open at Penney in February 2013. Penney and Martha Stewart will also develop an e-commerce site, expected to launch in 2013.

Home decor and cooking doyenne Martha Stewart said in a statement that the tie-up with Penney would put her company's products within easy reach of an even broader consumer audience.

Sales have been declining for years in Martha Stewart Living's magazine publishing, television and merchandising businesses.

The companies estimated that the arrangement would bring Martha Stewart Living more than $200 million, including royalty payments, design fees and advertising commitments, over the 10-year period of the contract.

Martha Stewart Living also said it would pay its shareholders a special dividend of 25 cents a share.

Penney's sales at stores open at least a year fell 1.6 percent in the last quarter and slipped 2 percent in November.

In May, Martha Stewart Living hired Blackstone Group (BX.N) to look at possibly selling the company, whose revenue had fallen by more than a quarter between 2007 and 2010.

Blackstone Advisory Partners was the financial adviser to Martha Stewart Living, while Peter J. Solomon Co advised Penney.

© Copyright Thomson Reuters {{Year}}. All rights reserved.