Treasury Secretary Mocked for Proposing to Raise the Debt Ceiling Without Using 'Any Gimmicks': 'Printing Money IS the Gimmick'

Experts warned the U.S. may run out of funding by July

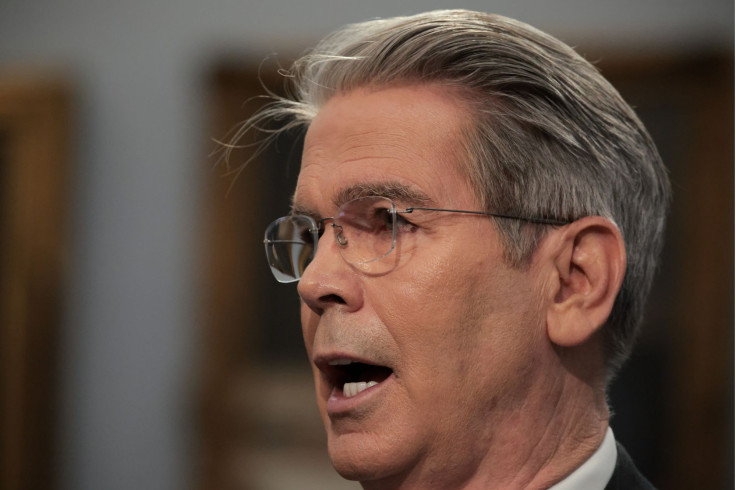

U.S. Treasury Secretary Scott Bessent was mocked online after testifying before a House appropriations subcommittee that the Trump administration plans to raise the debt ceiling without relying on "any gimmicks."

"The United States government will never default," Bessent asserted during a Tuesday hearing. "We will raise the debt ceiling, and treasury will not use any gimmicks."

"We will make sure that the debt ceiling is raised," he reiterated.

NOW - Scott Bessent: "The United States Government will never default. We will raise the debt ceiling."pic.twitter.com/F4drVBtvJH

— Disclose.tv (@disclosetv) May 6, 2025

The secretary's statement was then met with a barrage of comments online, several from users seemingly annoyed by government officials.

"Translation: we are going to print our way out of this," an X user commented.

Translation: we are going to print our way out of this

— MrBujok (@BujokMr) May 6, 2025

"Printing money IS the gimmick," another added.

Printing money IS the gimmick

— kyle (@AttemptingTech) May 6, 2025

"How can you default when you can just keep printing money out of thin air?" one user prompted.

How can you default when you can just keep printing money out of thin air?

— Steven Joe Brown (@Steviejoebrown) May 6, 2025

"Nobody expected anything else," another X user lamented.

Nobody expected anything else.

— Rick Lennon (@MrRickLennon) May 6, 2025

During the hearing, Bessent warned that the U.S. is "on the warning track" in terms of having enough money to meet its debt obligations. The debt limit, which was reinstated at $36.1 trillion on January 2, has forced the Trump administration to rely on "extraordinary measures" to continue paying the nation's bills without officially raising the ceiling, according to Politico.

The so-called X-date, or the point at which the government can no longer meet its financial obligations and risks default, is currently estimated to fall sometime in July, The New York Times reported.

Originally published on Latin Times

© Latin Times. All rights reserved. Do not reproduce without permission.