Did Corzine's Risk-Taking Cripple MF Global?

ANALYSIS

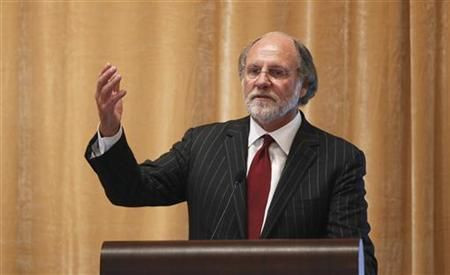

In early April, Jon Corzine was in a tough spot. MF Global, the company he had run for the previous year, was about to post a fourth-quarter loss, marking its fourth successive fiscal year of red ink.

For the former Goldman Sachs chief, it was a setback to his efforts to turn MF Global around. He had just announced a plan for the bank to boost trading risk by holding more assets on its books, both to help customers and to bet on markets.

He needed his traders to step up their game, and he called a group of them into a conference room at its Manhattan headquarters to lay out the plan.

"He basically told us that it was up to us to drive the profits of the firm," said a former MF Global trader who was in the room.

The trading, particularly in debt from troubled euro zone nations in the past year, has instead driven the firm to the brink of collapse, making it possibly the most prominent U.S. casualty yet from the euro zone crisis. It has also badly hurt Corzine's business image, and reduced the former New Jersey governor's chances of ever making a political comeback.

Corzine could not be reached for comment and MF Global declined comment. The firm was in talks with possible buyers on Sunday, though sources said all options were on the table as it had hired restructuring and bankruptcy advisers.

MF Global's fate has raised questions about whether the 64-year-old Corzine's affinity for risk-taking has finally caught up to him after a career that took him to the top echelons of Wall Street and then into politics as a U.S. senator and to the New Jersey state governor's mansion.

Corzine still has supporters on Wall Street who argue he was caught in a perfect storm but his detractors argue there have long been signs that Corzine could take imprudent risks. They point to Goldman Sachs' major trading losses under his watch in 1994, or when he sustained serious injuries in 2007 as a passenger in a speeding sports utility vehicle while not wearing a seatbelt.

In trying to become what some dubbed a mini-Goldman, Corzine's MF Global may have leveraged its bets too much and may not have paid enough attention to risk management.

He said in a call with analysts last Tuesday that MF Global sought to "take advantage of dislocations" in the sovereign debt market by buying what it saw as relatively low risk paper.

In interviews with more than a dozen former employees and competitors, a portrait emerges of Corzine struggling to transform the firm by ramping up risk. His strategic shift did not sit well with some employees, and came at a time when credit ratings agencies and financial markets are very unforgiving of high-risk strategies.

SINKING RATES PROBLEM

Retooling MF Global, whose roots trace back to a sugar brokerage started in London more than 200 years ago, was clearly necessary. Like other futures brokers its revenue was under pressure long before Corzine arrived in March 2010.

The brokers rely on commissions from executing trades, from clearing trades, and from the interest income they get from the cash collateral received from clients.

Interest revenue has been under sustained pressure throughout the U.S. economy given the Federal Reserve's decision to drop its benchmark rate to near zero, and to keep it there for a long time.

In its fiscal year ended in March, MF Global booked just $287 million of net interest income, a 60 percent decline from $731 million three years earlier.

"The business model isn't what it used to be," said Patrick Arbor, a former chairman of the Chicago Board of Trade and a long-time executive of a clearing broker.

Corzine could have shrunk MF Global's balance sheet or restructured. With the support of the board -- which in a recent regulatory filing applauded Corzine's choice -- he embarked on the strategy of transforming the company into what the filing described as "a commodities- and capital markets-focused investment bank."

While before, MF Global would link buyers up with sellers, or place trades on an exchange, the company would now hold an inventory of securities, potentially sitting on positions for longer, and betting on their price movements.

Carrying inventories usually requires more capital. But it seemed like a good move at a time when larger banks such as Goldman were being forced to limit their risk-taking because of increased regulation, according to a company presentation.

It was a big change for MF Global's employees, who had been more used to a conservative approach from management.

"If the market went against you and you had a problem, you got rid of it immediately. You never held onto positions," said Michael Gurka, who worked at MF Global from 2002 through 2006.

Another former employee recalled how risk averse MF Global had been in the past: "If a client wanted to sell in a panic situation, I couldn't buy it at 20 and sell it three days later at 30. If I bought something, I had to sell it to someone else immediately."

The repositioning has forced Corzine to lay off nearly 1,400 people and add 1,100 new employees, according to an MF Global presentation, bringing the staff total to nearly 2,900 at the end of September.

CULTURE CLASHES

Brad Abelow, a former Goldman colleague who served as his chief of staff and treasurer during his New Jersey gubernatorial term, was named president and chief operating officer. Other senior people joined, including Citigroup fixed income veteran Richard Moore in London who became the firm's European head. Corzine also hired hedge fund veteran Munir Javeri as global head of trading, and to oversee proprietary trading.

Culture clashes soon emerged. Some long-time MF Global employees derisively referred to a group of proprietary traders that were hired as "the league of extraordinary traders," two former employees said.

"In an environment with limited capital and limited distribution, the game is about singles and doubles, because if you go for a home run and miss, you might not live to play another day," said one MF trader who worked before and during Corzine's reign. There was "an enormous misunderstanding of the firm's assets and reach," he added.

Some sales staff complained that the firm was short on risk management, something companies like Goldman pride themselves on. Internecine squabbles among traders, salespeople and bankers are common at an investment bank, particularly when massive changes in strategy create internal winners and losers. But to Corzine's critics, his jump into sectors such as European debt investing brought serious risk.

As of October 25, the company had about $6.3 billion of European sovereign debt from some of the euro zone's more peripheral and troubled countries, including Italy, Spain, Portugal, Ireland and Belgium, though not Greece.

This exposure is enormous for MF Global -- equal to about five times the company's net worth, also known as its book equity, which was $1.23 billion as of the end of September. Without knowing the specific securities the company bought, or the price it paid for them, it is difficult to fully assess how risky the positions are.

LITTLE ROOM FOR ERROR

But MF Global's overall capital levels leave it with little margin for error. The company's book equity compares to an eye-popping $41.05 billion of assets, which means if the value of MF Global's assets falls more than about 3 percent, the company has wiped out the whole of its equity cushion and is out of business. Even a 1 percent decline could leave it dangerously undercapitalized.

The firm's leverage was on par with Lehman Brothers, even if its assets were safer.

The company insisted it was being prudent with its risk taking. In its most recently quarterly presentation last week, it argued it had low levels of illiquid assets, known as "level 3" assets. It pointed out that European sovereign investments are relatively safe, because they mature relatively soon -- by the end of 2012 -- and the European Financial Stability Facility backstops these countries through mid 2013.

Some former employees agree. On a risk scale of 1 to 10, "Corzine took us from being around 1 to maybe 3 or 4. He didn't take us to 11," said one former trader.

To these people, Corzine did exactly what the company needed to do to keep growing. And some who worked with him said portraits of him as a gunslinging trader are misguided.

"I can't speak to MF Global, but if he applied the same process there as he did when was conducting the affairs of government, I have to say he is a thoughtful, careful and prudent businessperson," said Steven Goldman, who served as Corzine's commissioner of banking and insurance in New Jersey from 2006 to 2009 and is now a partner at law firm Kramer Levin Naftalis & Frankel. "Decisions were never made from the hip."

Others say Corzine raised risk irresponsibly. "Everyone was running away from European debt. Maybe it's a money good trade, but just having to explain what they were doing to customers is taking the firm down," said another former trader.

The credit rating agencies have taken a dim view of the European investments, particularly after MF Global reported a $191.6 million second-quarter loss last Tuesday, more than double a year-earlier loss.

Moody's Investors Service and Fitch Ratings on Thursday slashed MF Global's debt rating to junk. Standard & Poor's said on Wednesday it might also cut the New York-based company's counterparty credit rating to junk.

Moody's said the downgrade reflected its view that "MF Global's weak core profitability contributed to it taking on substantial risk in the form of its exposure to European sovereign debt in peripheral countries."

Fitch appeared to refer to the European exposure more obliquely, saying the company's risk taking has resulted in "sizable concentrated positions relative to the firm's capital base, leaving MF vulnerable to potential credit deterioration and/or significant margin calls."

For a financial firm, a junk rating is a massive problem as it erodes confidence in its credit worthiness and can restrict its ability to borrow.

Last week, counterparties likely pressed MF Global to post more collateral on derivatives trades and may have started reducing the company's repo financing lines, market sources said.

"IN AWE"

MF Global drew down on its credit lines, saw some clients switch money to other brokers, and its shares lost more than two-thirds of their value.

For Corzine, who was brought in to run MF Global on the recommendation of his former Goldman colleague Christopher Flowers, the past week's events have hit not only his reputation but his wealth.

In March 2010, the day after MF Global announced his arrival, the company's shares rose 10 percent. "People were in awe of him," said Mike Fitzpatrick, a former oil broker and trader at MF Global.

But the 2.5 million options he received as a signing bonus, exercisable at $9.25 a share, are now underwater. MF stock closed October 28 at $1.20 a share.

He will also have lost money on purchases of 440,000 MF Global shares he made in June 2010, and June and August of 2011 for himself and a trust for his children. He paid at least $5.25 per share, with many bought for more than $7.00.

To see how quickly MF Global and Corzine have fallen, consider that in August, the firm sold debt with a provision that promised investors a full percentage point hike in interest if its CEO moved into a government role in particular.

Corzine had occasionally been touted in the media as a possible Treasury Secretary in an Obama administration, perhaps replacing current incumbent Timothy Geithner, and following in the footsteps of his former Goldman rival Henry Paulson.

At Goldman, he leveraged a naturally gregarious personality and trading skills to win the coveted role of partner just five years after joining the firm's bond division in 1975. By 1994 he was elevated to be chairman and chief executive.

That same year, Goldman amassed over $2 billion of losses that nearly erased its income from banking and caused an unusually large number of partners to leave.

Many investment bankers, who complained that their businesses required little capital, laid the loss at Corzine's door, according to former Goldman banker Jonathan Knee in his book "The Accidental Investment Banker."

Corzine, who was the son of a farmer in Illinois, was able to deflect the criticism by renewing his campaign to take the firm public and gain a new source of capital for its trading needs.

Many active and retired partners opposed the plan, but by quickly restoring Goldman to profitability and promoting Paulson in 1998 to become his deputy, Corzine won valuable support.

Corzine later lost out to Paulson in a power struggle, though, and by May 1999, as the IPO went forward and made Goldman's partners millionaires many times over, he resigned and soon turned to politics.

Deploying $62 million of his IPO bounty, he campaigned as a Democrat dark-horse candidate in primary and general elections for a U.S. Senate seat from New Jersey. Despite refusing to release his income tax records and gaffes such as when he joked about Italians who make "cement shoes" and were defended by Jewish lawyers, he won the election.

After one term in which he made only a modest number of headlines, Corzine in 2005 successfully campaigned to become New Jersey governor. He lost his campaign for reelection in 2009 to Republican Chris Christie and a few months later answered the call from Flowers, whose private equity firm J.C. Flowers had invested $300 million in MF Global in 2008, and joined the firm.

While he has many fans on Wall Street and beyond, some say his business and political careers are unlikely to recover from this latest blow. Whatever the outcome of talks over a sale or a restructuring few see much of a role for Corzine in MF Global's future.

"At the end of the day, for all his accomplishments, he will be remembered for MF," said a former finance executive at Goldman who now works at a competitor.

(Additional reporting by Paritosh Bansal, Jonathan Spicer, Jeanine Prezioso, and David Sheppard in New York. Editing by Martin Howell)

© Copyright Thomson Reuters {{Year}}. All rights reserved.