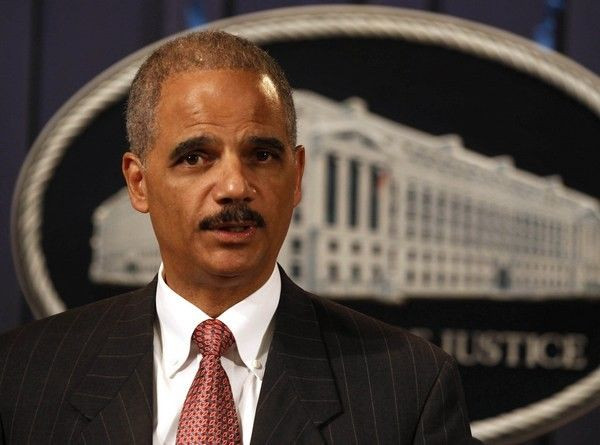

Eric Holder Launches Probe into Mortgage-Backed Securities Fraud

U.S. Attorney General Eric Holder Friday announced the formation of a task force focused on probing residential mortgage-backed securities following President Barack Obama's call for a unit to probe the finance industry's conduct leading up to the financial crisis.

The RMBS Working Group will focus on sniffing out wrongdoing in the process of pooling and packaging subprime mortgage loans into securities that were peddled to investors as attractive opportunities, Holder said. The investigation will build on the existing investigatory work at the U.S. Department of Justice.

"The working group will streamline and strengthen current and future efforts to identify, investigate, and prosecute instances of wrongdoing in the packaging, selling and valuing of residential mortgage-backed securities," Holder said. "I am confident that this new effort will improve our ability to ensure justice for victims; help restore faith in our financial markets and institutions; and allow us to answer the call that President Obama issued earlier this week, in his State of the Union address."

Obama made a high-profile appointment to the group in tapping New York Attorney General Eric Schneiderman, a first-term Democrat who had been pursuing his own investigations into conduct that led to the mortgage crisis and subsequent collapse of the financial system.

Schneiderman is co-chairing the working group with the Securities and Exchange Commission's enforcement chief, Robert Khuzami; John Walsh, a U.S. attorney in Colorado; Assistant Attorney General Tony West, chief of the Justice Department's civil division; and Assistant Attorney General Lanny Breuer, head of the department's criminal division.

Secretary of Housing and Urban Development Shaun Donovan will also take part in the working group.

"They've seen firsthand how massive failures in this market were a driving force behind the nationwide housing collapse that has had devastating effects for investors, consumers, and entire communities," Holder said.

This unit was announced in the middle of efforts to nail down a settlement over improper foreclosure practices between the nation's state attorneys general and five of the largest mortgage servicers in the nation -- Bank of America, JPMorgan Chase & Co., Citigroup, Wells Fargo and Ally Financial.

Schneiderman and fellow Democratic attorneys general Beau Biden of Delaware and Kamala Harris of California had been critical of the settlement because banks were seeking immunity from future actions related to the mortgage crisis that had yet to be investigated.

The announcement of the mortgage crisis investigation unit tamped down those concerns.

"Our working group is focusing on the conduct related to the pooling and creation of mortgage-backed securities ... the conduct that created the crash, not the abuses that happened after the fact," Schneiderman said Wednesday.

--

© Copyright IBTimes 2025. All rights reserved.