Chris Christie Administration Will Disclose Hidden Fees Paid By State Pension To Wall Street Firms

After months of stalling, Chris Christie’s appointees have agreed to fully disclose five years’ worth of fees sent to the financial industry. New Jersey pension trustees had demanded a forensic audit of the fees the administration had paid Wall Street firms managing the state’s pension money.

The calls for the audit followed an investigative series by International Business Times showing that fees paid to Wall Street firms had increased significantly under Gov. Christie and that his administration had failed to disclose potentially hundreds of millions of dollars in additional fees the state had paid on its alternative-investment deals.

The New Jersey pension system’s 2014 annual report showed that the state had paid $600 million in fees to financial firms -- a 50 percent increase in disclosed fees from the year before. However, reports from previous years did not account for all the so-called performance fees charged by private-equity and real estate firms. The Christie administration’s move to disclose these fees is part of a larger trend toward transparency: On Tuesday, the nation’s largest pension system, in California, released a full accounting of the fees it had paid to private-equity firms over the past 25 years.

As IBT reported, some of the Christie administration’s alternative-investment deals were made with firms whose executives had made major campaign contributions to political groups supporting Christie. In one instance, the state of New Jersey paid a major financial firm nearly double the fees it had disclosed, IBT found. The state maintained the investment with that company, Prudential Financial, even after one of its top officials donated to and raised funds for Christie’s campaigns -- despite state pay-to-play rules designed to cancel deals under those circumstances.

IBT’s reports prompted a special state legislative hearing where lawmakers questioned Christie’s state treasurer, Andrew Sidamon-Eristoff, about the fees. Sidamon-Eristoff resigned soon after -- the second Christie pension official to resign within a year. State legislators also passed a bill to prevent campaign contributions to groups affiliated with Christie. The governor vetoed that legislation in May.

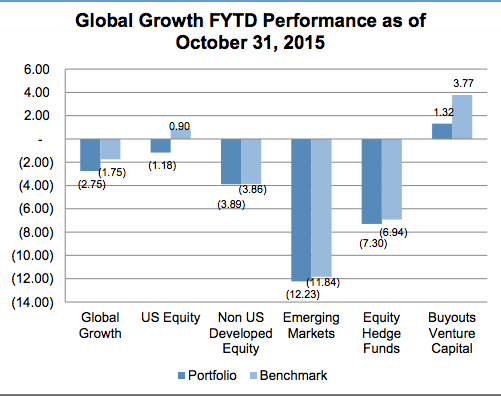

While Christie’s appointees have consistently defended the state’s increased stake in alternative investments, a recent report from the pension system shows the results have been subpar and lower than anticipated.

© Copyright IBTimes 2025. All rights reserved.